Welcome to the first edition of our 2026 monthly tax update. As the Gulf region continues to refine its tax frameworks, businesses operating across the GCC face an environment marked by greater sophistication, enhanced enforcement mechanisms, and accelerated digitalisation. This newsletter examines the regulatory developments that closed out 2025 and those taking effect as we begin the new year.

The final quarter of 2025 saw substantial legislative activity across the United Arab Emirates and several neighbouring jurisdictions, particularly Saudi Arabia and Oman. These changes touch every major tax head, from corporate and indirect taxes to excise duties and procedural rules and extend to the digital infrastructure that now underpins compliance in the region.

This edition covers recent developments in UAE Corporate Tax, VAT, Tax Procedures, Excise Tax, and e-invoicing. It also reviews guidance from Saudi Arabia’s ZATCA on electronic marketplaces, Oman’s progress toward mandatory e-invoicing, and international tax treaty updates involving GCC countries.

We trust this update provides useful context as you assess the compliance and planning implications for your business.

UAE Corporate Tax: Targeted Legislative Amendments

UAE Corporate Tax: Targeted Legislative Amendments

On October 14, 2025, the UAE enacted Federal Decree-Law No. 28 of 2025, which amends certain provisions of the Corporate Tax Law (Federal Decree-Law No. 47 of 2022). The changes are technical in nature but improve the internal coherence of the legislation and clarify how tax liabilities are settled when multiple types of credits or reliefs are available.

Article 44: Settlement hierarchy

The amended Article 44 now explicitly refers to “credits, incentives, and reliefs” when describing how Corporate Tax liabilities are settled. Previously, the article addressed withholding tax credits and foreign tax credits but did not expressly mention other forms of offset that might be introduced by Cabinet Decision.

The legal order of settlement remains:

- Withholding tax credits (Article 46)

- Foreign tax credits (Article 47)

- Any other credits, incentives, or reliefs approved by Cabinet Decision

- Cash payment of any remaining balance

This amendment eliminates potential ambiguity when new incentive regimes are rolled out and makes clear that such offsets will slot into a defined hierarchy rather than operating in isolation.

Article 49-bis: Mechanism for unused credits

A new article has been inserted, Article 49-bis which establishes a framework for the treatment of unused Corporate Tax credits. This is relevant where a taxpayer has accumulated credits under Article 20 (incentives and reliefs) or other provisions referenced in Article 44(3) but has insufficient tax liability to absorb them.

Under the new article, the Minister of Finance is authorised to issue Cabinet Decisions setting out:

- The conditions under which unused credits may be claimed

- The process for submission and review of such claims

- The manner in which approved claims will be settled (whether by payment or set off)

The law also provides that payments relating to approved unused credit claims may be funded from collections of Corporate Tax and, where applicable, top-up tax under the domestic minimum tax rules. Such payments require approval by the Board of the Federal Tax Authority.

While the UAE has not formally commented on the policy intent, the introduction of Article 49-bis likely lays the groundwork for future alignment with OECD guidance on Qualifying Refundable Tax Credits under Pillar Two, particularly for incentives that are intended to have real economic effect rather than remaining theoretical.

Federal Decree-Law No. 28 of 2025 was published in the Official Gazette and is now in force. The Arabic text is available on the UAE Official Gazette portal.

UAE Advance Pricing Agreements: Transfer Pricing Certainty Framework

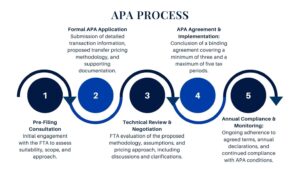

In January 2026, the Federal Tax Authority issued comprehensive guidance on Advance Pricing Agreements (APAs) under the UAE Corporate Tax regime. This framework provides businesses with a formal mechanism to obtain prospective certainty on the tax treatment of related party transactions.

What is an Advance Pricing Agreement?

An APA is a binding agreement between a Taxable Person and the FTA that pre-determines how the arm’s length principle will be applied to specific related party transactions over a defined future period. Unlike retrospective transfer pricing documentation, APAs establish agreed pricing methodologies in advance.

Under the UAE framework, APAs cover a minimum of three and a maximum of five tax periods, provide prospective certainty for covered transactions, and are binding on both parties subject to continued compliance with agreed terms and conditions.

Phased implementation

The FTA has introduced the APA programme in phases:

- December 2025: Unilateral APAs for domestic related party transactions (both parties UAE tax residents)

- Expected 2026: Cross-border unilateral APAs (transactions between UAE residents and non-resident related parties)

- Future phases: Bilateral and multilateral APAs through Mutual Agreement Procedure, subject to applicable tax treaties

Eligibility and fees

The programme targets transactions with an aggregate arm’s length value of AED 100 million or more per tax period. The FTA evaluates applications case-by-case, considering transaction complexity, specific facts, and tax risk profile.

A non-refundable application fee of AED 30,000 applies for new applications, with a reduced fee of AED 15,000 for renewals.

Relevant for which businesses?

APAs are particularly suited for businesses with:

- Complex group structures involving Free Zone and mainland entities

- Recurring cross-border charges (management fees, royalties, technical services)

- Significant transfer pricing audit exposure

- Need for long-term Corporate Tax certainty for strategic planning

Strategic benefits

Beyond compliance, APAs deliver reduced audit exposure for covered transactions, tax certainty over multi-year periods, enhanced transfer pricing governance and documentation discipline, and improved stakeholder confidence.

Practical considerations

The APA process is resource-intensive, typically requiring 12–18 months from initial engagement to conclusion. Businesses must maintain comprehensive functional and economic analysis, comply with agreed terms throughout the APA period, and submit annual compliance reports. Changes in business circumstances may require renegotiation or withdrawal.

Businesses should conduct feasibility assessments to determine whether the benefits of certainty justify the compliance costs and procedural requirements.

The introduction of the APA framework reflects the UAE’s commitment to building a mature, internationally aligned Corporate Tax system. For businesses with significant transfer pricing exposures, APAs represent a valuable tool for achieving tax certainty and managing regulatory risk transparently.

Further details on application procedures and technical requirements are expected from the FTA in the coming months.

UAE VAT: Four Key Amendments to the VAT Law

On December 3, 2025, the Ministry of Finance announced the promulgation of Federal Decree-Law No. 16 of 2025, which amends Federal Decree-Law No. 8 of 2017 on Value Added Tax. The amendments address procedural simplifications, tighten compliance standards in high-risk scenarios, and impose time limits on the use of accumulated VAT credits.

- Simplification of the reverse charge mechanism

Where a taxable person imports goods or services from outside the UAE for use in the course of business, the supply is treated under the reverse charge as being made by the person to himself. Previously, this required the person to self-issue a tax invoice.

The amended law removes the self-invoicing requirement. The taxable person remains required to account for output tax on the deemed supply and may claim input tax to the extent the goods or services are used for taxable purposes but no longer needs to generate a formal tax invoice in his own name.

This change reduces administrative steps and aligns with the FTA’s earlier administrative relaxation published in Public Clarification VATP044.

- Denial of input tax recovery in evasion chains

A new provision denies input tax recovery where two conditions are met: the supply forms part of a transaction connected to tax evasion, and the recipient knew or should have known. The law specifies that a person “should have known” if they failed to take reasonable steps to verify the legitimacy of the supply or credibility of the supplier.

This is modelled on the principle established by the European Court of Justice in Case C-439/04 (Axel Kittel v État belge and Recolta Recycling SPRL). In practical terms, the amendment places an affirmative due diligence obligation on UAE businesses. Valid tax invoices are no longer sufficient on their own. Taxpayers must demonstrate that they took reasonable steps to verify that their suppliers are genuine, that transactions reflect commercial reality, and that there are no indicators suggesting involvement in VAT evasion schemes.

- Five-year limitation on use of excess recoverable VAT

Under the amended law, excess input tax balances that have not been used to offset output tax or claimed as a refund within five years from the end of the tax period in which they arose will be forfeited.

This introduces time discipline into VAT credit management and prevents the indefinite accumulation of unused balances. A transitional provision (discussed below under Tax Procedures amendments) allows businesses a grace period to address credits that would otherwise expire in the near term.

- Alignment of VAT audit limitation with general procedural rules

From January 1, 2026, VAT audits and assessments are governed by the general limitation rules set out in the Tax Procedures Law (Federal Decree-Law No. 28 of 2022, as amended). This creates a unified procedural framework applicable to all federal taxes.

The full text of Federal Decree-Law No. 16 of 2025 is available on the UAE Official Gazette portal.

UAE Tax Procedures: Major Overhaul of Limitation Rules and Powers

On the same day, the Ministry of Finance announced Federal Decree-Law No. 17 of 2025, which makes wide-ranging amendments to the Tax Procedures Law (Federal Decree-Law No. 28 of 2022). These changes affect limitation periods for refunds, audits, and assessments; the treatment of nil-impact errors; the FTA’s power to issue binding guidance; and transitional relief for legacy matters.

- Five-year limitation on refunds and credit use

A general rule now applies across all FTA-administered taxes: refunds and the use of credit balances must occur within five years from the end of the tax period to which they relate. After that point, unused credits are forfeited and refund claims are time-barred.

This applies to VAT excess input tax, Corporate Tax credits and overpayments, Excise Tax credits, and any other federal tax administered by the FTA.

The limitation is measured from the end of the tax period, not from the date of filing or payment. For example, for a VAT return covering Q1 2021 (ending March 31, 2021), any credit balance would need to be used or claimed by March 31, 2026.

- Simplified correction of nil-impact errors

Where a taxpayer identifies an error in a filed tax return that has no effect on the amount of tax due (for example, a classification error between two categories subject to the same rate), the error may now be corrected in a subsequent return without the need to file a formal voluntary disclosure. This reduces compliance friction and allows businesses to address immaterial errors through normal return cycles.

- Revised refund claim framework

Article 38 of the Tax Procedures Law has been amended to clarify the deadlines within which refund requests must be submitted, define circumstances in which the FTA may grant extensions, and set out when credit balances expire if not claimed in time.

- Limitation periods for audits and assessments

The standard limitation period for FTA audits and assessments is five years from the end of the tax period. However, this may be extended to up to 15 years where there is evidence of tax evasion, deliberate misstatement, or failure to register for tax when required, or an additional two years where a refund claim is submitted in the fifth year following the relevant tax period.

- Authority to issue binding guidance

A new article 54-bis empowers the FTA to issue binding public rulings on the interpretation of tax law, procedural directives, and technical guidance that taxpayers and tax agents may rely upon. Previously, the FTA’s public clarifications and guidance notes were treated as persuasive but not legally binding.

- Transitional provisions for legacy credits and voluntary disclosures

Recognising that the five-year limitation could cause forfeiture of credits that businesses have been legitimately carrying forward, the law includes transitional measures:

- Taxpayers have until December 31, 2026, to use or claim credits that have already expired or that will expire within 12 months of January 1, 2026

- Where voluntary disclosures are linked to refund claims, extended timeframes apply to allow the FTA to complete its review

- Where refund claims are made under transitional provisions, the FTA has an additional two-year window to conduct audits or issue assessments

The full text of Federal Decree-Law No. 17 of 2025 is available on the UAE Official Gazette portal.

UAE VAT Administrative Exceptions Guide Updated

In December 2025, the FTA published an updated version of the VAT Administrative Exceptions Guide (VATGEX1), setting out circumstances in which VAT registrants may apply for administrative exceptions to strict compliance with certain provisions of the VAT Law and Executive Regulations.

The guide addresses four categories of exceptions: acceptance of non-compliant or late-issued tax invoices (Article 59(7)), acceptance of non-compliant or late-issued tax credit notes (Article 60(2)), acceptance of alternative evidence to prove the export of goods (Article 30(6)), and extension of the 90-day time limit for exporting goods from the UAE (Article 30(7)).

Only registered persons holding a valid Tax Registration Number may apply. Applications are submitted through EmaraTax, supported by documentation explaining why the exception is justified. Approvals are generally valid for three years and may be applied retroactively for up to five years prior to the application date.

Recent changes

The December 2025 update includes: addition of a glossary defining key VAT terms, removal of exceptions now managed directly within EmaraTax, clarification of documentary evidence required for exports, a new section highlighting common applicant mistakes, alignment with FTA Decision No. 2 of 2025, and inclusion of an annex containing a visual process map and pre-submission checklist.

The FTA’s review period is 25 business days for straightforward cases and 45 business days for more complex applications.

Practical implications

The updated guide raises the bar for exception requests. Businesses should:

- Ensure they have a clear understanding of which exception category applies.

- Provide comprehensive factual context and explain why strict compliance is not feasible.

- Use the new checklist to verify that all required documents are included.

- Be prepared to substantiate that any alternative evidence (for example, in the case of exports) is reliable and sufficiently probative.

The updated VAT Administrative Exceptions Guide is available on the FTA’s website.

UAE Profit Margin Scheme: FTA Guidance Issued

In January 2026, the Federal Tax Authority published VAT Guide VATGPM1 – Profit Margin Scheme, providing the first comprehensive official guidance on Article 29 of the UAE VAT Executive Regulation. This addresses a specific compliance issue for businesses reselling goods that have already borne VAT earlier in the supply chain.

How the Scheme works

Under standard VAT rules, tax is charged on the full selling price. The Profit Margin Scheme limits the VAT base to the reseller’s margin—the difference between purchase price and selling price. The margin is treated as VAT-inclusive, and VAT is extracted using the fraction 5/105 (or by dividing the margin by 21).

Where a reseller purchases goods for AED 50,000 and sells them for AED 80,000, the margin is AED 30,000. VAT due is AED 1,428.57 (30,000 ÷ 21), rather than AED 3,809.52 under standard treatment.

Qualifying goods

The Scheme applies only where goods were previously subject to UAE VAT and fall within these categories:

- Second-hand goods suitable for reuse (used vehicles, electronics, furniture)

- Antiques older than 50 years

- Collector’s items (stamps, coins, items of historical interest)

- Article 53 goods where input tax recovery was blocked

Goods acquired before January 1, 2018, do not qualify. Resellers must retain documentary evidence proving prior VAT exposure.

Compliance requirements

The Scheme is optional and applied transaction-by-transaction. No prior FTA approval is required, but once a tax invoice showing VAT is issued, the Scheme cannot be applied to that transaction.

When using the Scheme, resellers must:

- Issue invoices stating “VAT charged with reference to Profit Margin Scheme” without showing the VAT amount separately

- Maintain stock registers and purchase documentation, including self-issued invoices for purchases from non-registrants

- Retain proof of prior VAT treatment

- Declare Scheme usage in the VAT return

VAT return reporting

- Box 9: Report purchase price in Amount column only (no VAT amount)

- Box 1: Report selling price minus VAT on margin in Amount column; VAT on margin in VAT Amount column

Goods sold at a loss have no VAT due, and losses cannot offset profits on other transactions.

Implementation challenges

Key practical issues include obtaining documentary evidence of prior VAT from non-registrant sellers, modifying invoice templates to comply with Scheme-specific requirements, tracking margins at individual transaction level, and configuring accounting systems for margin-based calculations.

Businesses should review inventory eligibility, implement documentation procedures at point of purchase, update invoicing systems, and train personnel on compliance requirements. The Scheme offers meaningful VAT relief but demands disciplined controls to mitigate audit risk.

The full text of VAT Guide VATGPM1 is available on the FTA’s website.

UAE E-Invoicing: Penalties for Non-Compliance

On October 9, 2025, the UAE Cabinet issued Cabinet Decision No. 106 of 2025 on the Violations and Administrative Penalties Resulting from Violation of the Legislation Regulating the Electronic Invoicing System. The decision was published in the Official Gazette (Issue No. 809) on October 14, 2025, and entered into force on October 15, 2025.

This decision establishes the penalty framework applicable to entities required to comply with the UAE’s electronic invoicing regime. It applies to all persons subject to mandatory e-invoicing requirements under the Tax Procedures Law but does not apply to those who issue electronic invoices on a voluntary basis.

Key definitions

The decision defines “System Failure” as any malfunction, disruption, or unavailability of the Electronic Invoicing System that prevents a person from meeting their compliance obligations. “Electronic Invoice” and “Electronic Credit Note” are defined as documents issued in a structured electronic format that enables automated processing in accordance with the technical specifications of the Electronic Invoicing System.

Penalty structure

Key violations include failure to implement or register on the Electronic Invoicing System by the applicable deadline, issuing invoices outside the system when required, issuing invoices that do not comply with the prescribed technical format, failure to transmit invoices to the FTA within the required timeframe, and failure to notify the FTA of system failures. Penalties vary depending on the nature and frequency of the violation.

Next steps for businesses

Businesses with annual revenue exceeding AED 50 million are required to select an Authorized Service Provider (ASP) by July 31, 2026. Implementation typically requires changes to ERP systems, integration with ASP platforms, and staff training.

The full text of Cabinet Decision No. 106 of 2025 is available on the UAE Official Gazette portal.

UAE Excise Tax: Modernisation of the Framework

The UAE’s excise tax regime is being modernised through legislative amendments and detailed implementation decisions issued by the FTA, reflecting a shift toward a more tiered, health-oriented approach to excise taxation, particularly for sugar-sweetened beverages.

Cabinet Decision No. 198 of 2025

On December 18, 2025, the Ministry of Finance announced Cabinet Decision No. 198 of 2025, which amends the Executive Regulation of the Excise Tax Law. The amendments align with recent changes to the primary legislation, clarify registration and deregistration procedures for excise taxpayers, set out the documentation required to support claims for excise tax deductions, and refine the rules on refunds, including in cases where excisable goods are exported.

FTA Decision No. 10 of 2025: Sugar content determination

On December 25, 2025, the FTA issued FTA Decision No. 10 of 2025, which prescribes the methodology for determining the percentage of sugar in sweetened beverages and concentrated products. The decision came into effect on January 1, 2026.

The UAE now taxes sweetened drinks on a tiered basis according to their sugar content, rather than applying a flat rate. Sugar content must be determined through laboratory testing using specified methods.

FTA Decision No. 11 of 2025: Expanded deduction scenarios

Also issued on December 25, 2025, FTA Decision No. 11 of 2025 expands the circumstances in which excise tax deductions are permitted, effective January 1, 2026.

Two new deduction scenarios are introduced:

Natural shortage inspection loss: Where excisable goods are removed from a Designated Zone for regulatory inspection and are damaged or rendered irrecoverable during the inspection process, the excise tax paid on those goods may be deducted.

Reclassification of sweetened drinks: Transitional relief is provided for sweetened beverages initially taxed on a high-sugar classification where subsequent laboratory testing establishes a lower-sugar category. The taxable person may deduct the excess excise tax previously paid, provided the deduction is claimed between January 1 and June 30, 2026, laboratory reports and stock control records substantiate the reclassification, and the goods were held in inventory.

The full texts of Cabinet Decision No. 198 of 2025, FTA Decision No. 10 of 2025, and FTA Decision No. 11 of 2025 are available on the UAE Ministry of Finance and FTA websites.

UAE: FTA Decision on Declining Refunds During Audits

On December 4, 2025, the FTA issued FTA Decision No. 9 of 2025, effective January 1, 2026, setting out circumstances in which the FTA may decline or suspend processing of refund requests submitted by taxpayers who are under audit.

Circumstances permitting refund suspension

The FTA may decline or suspend refund requests where: preliminary audit findings suggest the taxpayer may owe significant additional tax, there are reasonable grounds to believe the taxpayer is engaged in tax evasion, the refund relates to goods or services suspected of being involved in VAT fraud, the taxpayer has unfiled returns, the taxpayer does not provide requested documentation, or the taxpayer fails to cooperate with audit obligations.

Practical implications

Refunds are often critical to business cash flow. Under the new framework, businesses under audit should expect more rigorous scrutiny, possible payment delays, and potential refusal where risk indicators are present.

Businesses can mitigate these risks by ensuring all tax returns are filed on time, maintaining comprehensive documentation supporting refund claims, responding promptly to FTA information requests, implementing robust internal controls, and cooperating fully with audit procedures.

The full text of FTA Decision No. 9 of 2025 is available on the FTA website.

Saudi Arabia: ZATCA Guidance on E-Marketplaces

In December 2025, ZATCA published detailed guidance on the VAT treatment of supplies facilitated through electronic marketplaces, addressing recent amendments to the KSA VAT Implementing Regulations effective January 1, 2026.

Background

Since 2018, electronic marketplace operators have been treated as the deemed supplier of e-services provided by non-resident suppliers under Article 47(2). In November 2024, Article 47(3) was added, extending deemed supplier treatment to any goods or services facilitated where the underlying supplier is an unregistered KSA resident and the customer is in the Kingdom.

Key points

The test for “facilitate” is substance-based. A platform facilitates a supply where it plays a material role including setting prices, controlling payment processing, assigning customers to suppliers, or handling customer service.

For example, a ride-hailing platform that assigns trips, sets pricing, processes payments, and manages complaints will be deemed the supplier for VAT purposes. By contrast, a listing-only platform where customers contact suppliers directly is unlikely to meet the facilitation test.

Where the platform is the deemed supplier, VAT applies to the full value of the supply, not just the platform’s commission. Platforms are responsible for verifying supplier residency and VAT registration status.

The expanded deemed supplier rules apply from January 1, 2026. The ZATCA guidance (available in Arabic) can be accessed on the ZATCA website.

Oman: E-Invoicing Implementation Roadmap Confirmed

On December 9, 2025, the Oman Tax Authority (OTA) published the first draft of its e-invoicing data dictionary and held consultation workshops clarifying the implementation roadmap for mandatory e-invoicing in Oman.

What is the data dictionary?

The data dictionary defines the information required in a compliant electronic invoice under Oman’s e-invoicing system (“Fawtara”). It is structured around three components: business terms (document types and required data fields), business rules (validation checks and logical conditions), and code lists (standardised reference codes).

Implementation timeline

- Q4 2025: Data dictionary publication

- Q1 2026: Service provider registration portal opening

- Q2 2026: Testing phase

- Q3 2026: System go-live

Phased rollout

- Batch 1 (Q3 2026): Selected large taxpayers for B2B, B2G, B2C

- Batch 2 (Q1 2027): All large taxpayers for B2B, B2G, B2C

- Batch 3 (Q3 2027): All VAT-registered taxpayers for B2B, B2G, B2C

- Batch 4 (Q1 2028): All taxpayers for B2B, B2G, B2C, G2B

Businesses should review the data dictionary, engage with ERP vendors, monitor OTA announcements, and begin testing integration once the accreditation process opens.

Further details are available on the OTA website.

Recent Developments in Tax Treaties and Trade Agreements

The past two months have seen notable activity in the GCC region’s network of international tax treaties and investment agreements, underscoring the region’s continued commitment to expanding cross-border economic engagement.

Austria–Kuwait Protocol: On December 10, 2025, the Austrian National Council approved the amending protocol to the Austria–Kuwait Income and Capital Tax Treaty, updating provisions related to treaty abuse and dispute resolution.

Burundi–UAE Treaty reapproved: On November 26, 2025, the Burundi Council of Ministers reapproved the Burundi–UAE Income Tax Treaty, originally agreed in 2017.

Chile–UAE CEPA: The Comprehensive Economic Partnership Agreement between Chile and the UAE entered into force on November 24, 2025, eliminating or reducing customs duties, liberalising services, and including provisions on digital trade and investment protection.

Ecuador–UAE IPPA: On December 6, 2025, Ecuador and the UAE signed an Investment Promotion and Protection Agreement providing legal protections for investors, guarantees of fair treatment, protection against expropriation, and free transfer of funds.

Qatar–Uruguay Treaties: On December 7, 2025, Qatar and Uruguay signed both an Income Tax Treaty and an Investment Promotion and Protection Agreement, allocating taxing rights, providing for information exchange, and establishing investment protections.

Qatar–Saudi Arabia Treaty: The Income Tax Treaty between Qatar and Saudi Arabia entered into force on January 1, 2026, including provisions on withholding taxes and capital gains relief.

Strategic context

Collectively, these developments reduce double taxation, lower trade barriers, provide investor protections, promote transparency, and facilitate regional economic integration.

Conclusion

The developments covered in this newsletter represent a continuation of the regulatory trajectory that has defined the GCC tax landscape: increasing sophistication, tighter enforcement, enhanced digitalisation, and deeper integration into international standards.

For businesses, compliance now requires robust systems, comprehensive documentation, proactive monitoring of regulatory changes, and transparent engagement with tax authorities.

At Corporate Group, we work with businesses across the region to navigate these complexities. Whether you need support with Corporate Tax compliance, VAT advisory, transfer pricing, e-invoicing readiness, or audit representation, our team is available to assist.

We welcome your feedback on this newsletter and any questions you may have regarding the topics covered.

Corporate Group Dubai

Tax & Audit Advisory

www.corporategroup.me

info@corporategroup.me

+971 54 289 6858

This newsletter is intended for general information purposes only and does not constitute legal or tax advice. Specific circumstances should be evaluated with the assistance of qualified professional advisors.

UAE Corporate Tax: Targeted Legislative Amendments

UAE Corporate Tax: Targeted Legislative Amendments