Introduction

The rapid advancement of technology in finance has led to significant changes and innovations within the industry. One of the key factors driving this transformation is the integration of Artificial Intelligence (AI) and Machine Learning (ML). These cutting-edge technologies have the potential to revolutionize the way we manage investments, detect fraud, and make data-driven decisions in the financial sector. With AI and ML, financial institutions and investors can leverage advanced algorithms to analyze vast amounts of financial data. These technologies can identify patterns, trends, and correlations that might go unnoticed by human analysts. This enables more accurate predictions and informed decision-making when it comes to managing investments and optimizing portfolios.

AI and ML play a crucial role in investment management and risk assessment processes. By analyzing diverse data sources like market data, economic indicators, news sentiment, and social media trends, financial institutions can accurately assess and predict risks, leading to better risk management strategies. AI and ML also aid in fraud detection and prevention, enabling early intervention and prevention by analyzing large datasets and leveraging pattern recognition algorithms. This proactive approach safeguards financial institutions and customers from fraudulent activities, enhancing investment management and ensuring a safer financial landscape.

Understanding AI and Machine Learning

Artificial Intelligence (AI)

In the field of finance, Artificial Intelligence (AI) refers to the development of intelligent systems capable of performing tasks that typically require human intelligence. These systems are built using algorithms and models that enable machines to analyze data, make decisions, and learn from their experiences. AI encompasses various subfields and technologies that contribute to the advancement of intelligent systems in finance.

Machine Learning (ML)

Machine Learning (ML) is a subset of AI that focuses on training algorithms to learn from data and improve their performance over time. ML algorithms have the ability to automatically identify patterns, extract valuable insights, and make predictions without being explicitly programmed. This is achieved by training the algorithms on historical financial data, economic indicators, and other relevant information. ML algorithms continuously learn from new data, enabling them to adapt and improve their performance in financial applications.

Applications in Finance

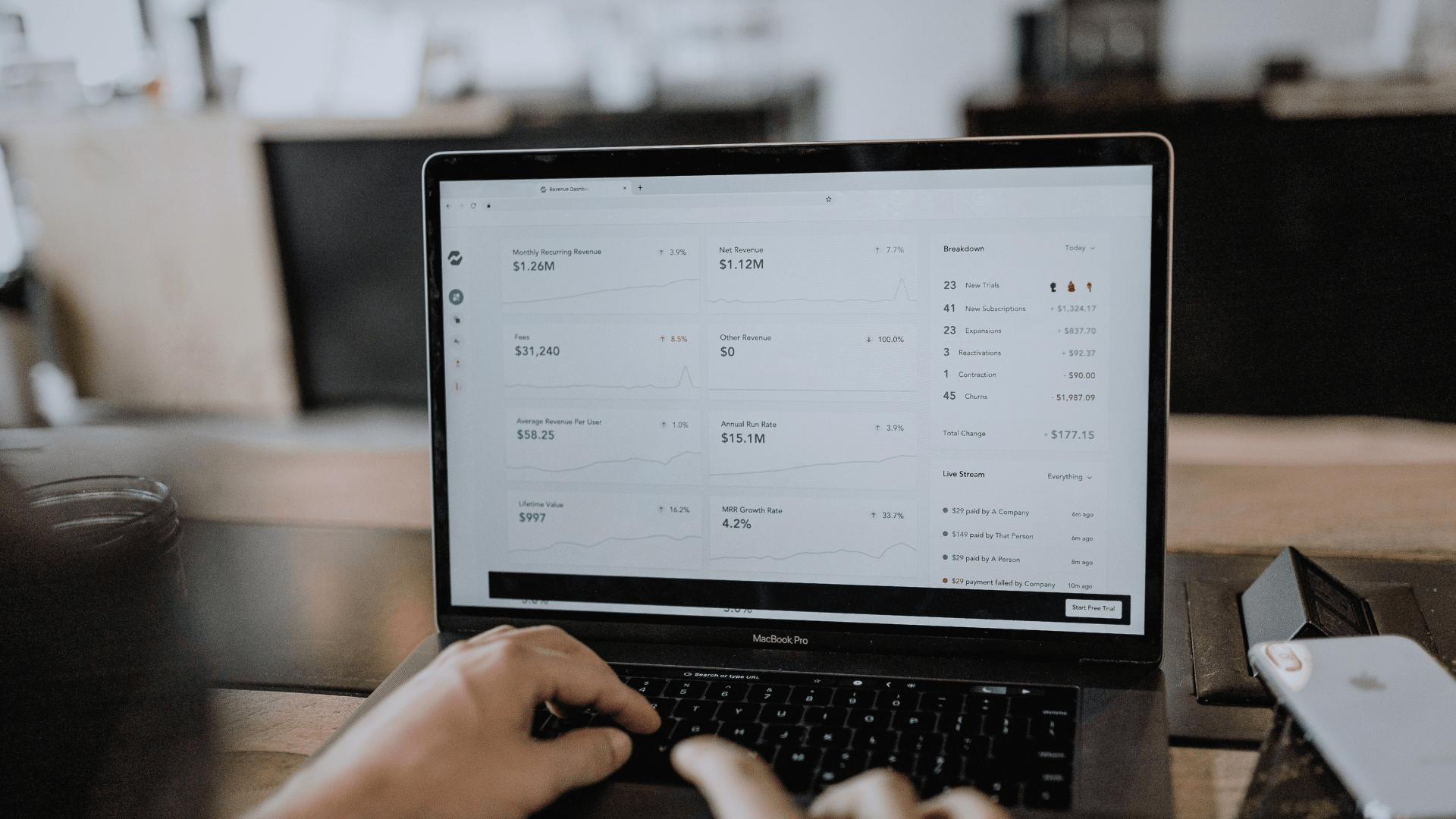

In the context of finance, AI and ML offer powerful tools for analyzing large volumes of financial data and extracting valuable insights. By leveraging AI and ML technologies, financial professionals can make more informed decisions and optimize various aspects of financial services. ML algorithms can identify patterns and correlations in financial data that human analysts may miss, providing deeper insights into market trends, risk factors, and investment opportunities.

Types of Machine Learning Algorithms

ML algorithms can be categorized into different types, including supervised learning, unsupervised learning, and reinforcement learning. In supervised learning, algorithms are trained on labeled data, where the algorithm learns to make predictions based on input-output pairs. Unsupervised learning involves training on unlabeled data, allowing the algorithm to discover patterns and structures within the data. Reinforcement learning is a type of learning where an algorithm interacts with an environment, learning to make decisions based on feedback and rewards.

Benefits and advancements

The utilization of AI and ML in finance brings numerous benefits to the industry. These technologies can handle vast amounts of financial data, analyze complex relationships, and provide accurate predictions. ML algorithms can adapt and improve their performance as they encounter new data, enabling continuous learning and optimization of financial processes. Advancements in AI and ML continue to enhance the capabilities of intelligent systems, opening up new opportunities for automation, risk management, fraud detection, and personalized customer experiences in finance.

Enhancing Investment Management

AI and ML in investment management

The integration of Artificial Intelligence (AI) and Machine Learning (ML) has brought significant benefits to the field of investment management. AI and ML technologies can analyze vast amounts of financial data, identify patterns, and make accurate predictions. This enables financial professionals to gain deeper insights into market trends, risk factors, and investment opportunities. By leveraging AI and ML, investment managers can make more informed decisions, optimize portfolios, and improve overall investment performance.

Portfolio optimization and risk assessment

AI and ML play a crucial role in portfolio optimization and risk assessment. These technologies can analyze historical data, market trends, and various financial indicators to identify optimal portfolio allocations. By incorporating ML algorithms, investment managers can develop sophisticated models that consider risk factors, correlations, and diversification strategies. This helps in constructing portfolios that are better positioned to achieve desired risk-return profiles, enhancing investment performance and risk management.

Rise of AI-powered Robo-advisors

AI-powered robo-advisors offer automated investment advisory services to individual investors, analyzing investor preferences, risk tolerance, and financial goals. These platforms offer personalized recommendations and portfolio management services at lower costs compared to traditional human advisors. This accessibility and convenience make investment management services more inclusive and affordable for a broader range of investors.

Risk Assessment Optimization

Limitations of traditional risk models

Traditional risk models in finance often face limitations in capturing complex and dynamic risks. These models rely on predetermined assumptions and may not adequately account for rapidly changing market conditions or unforeseen events. As a result, there is a need for more sophisticated approaches to risk assessment that can adapt to the evolving nature of financial risks.

AI and ML for accurate risk assessment

AI and ML offer powerful tools for streamlining risk assessment processes in finance. These technologies can analyze diverse data sources, including market data, economic indicators, news sentiment, and social media trends. By training ML algorithms on this data, financial institutions can gain deeper insights into risk factors, identify emerging risks, and make more accurate predictions. AI and ML enable the analysis of large datasets in real-time, allowing for proactive risk management and timely decision-making.

Diverse data sources for risk prediction

The integration of AI and ML in risk assessment enables financial institutions to leverage a wide range of data sources. By combining structured and unstructured data, such as financial statements, market data, and news articles, AI algorithms can uncover hidden patterns and correlations. This holistic approach to data analysis enhances risk prediction capabilities and enables more comprehensive risk assessment strategies. By considering a diverse range of data sources, financial institutions can gain a more comprehensive understanding of risks and develop proactive risk management strategies.

Fraud Detection and Prevention

Combating financial fraud

Financial fraud poses a significant challenge for the industry, causing significant losses and damaging trust. Detecting and preventing fraud is crucial for protecting financial institutions and customers. Traditional methods rely on rules-based systems, which may struggle with evolving patterns. As fraudsters become more sophisticated, advanced technologies like AI and ML are needed to enhance fraud detection capabilities.

AI and ML’s Role in fraud detection and prevention

AI and ML technologies offer powerful solutions for detecting and preventing financial fraud. These technologies can analyze large volumes of data in real-time, including transaction records, customer behavior, and historical fraud patterns. By employing ML algorithms, financial institutions can identify anomalies and patterns associated with fraudulent activities. This enables early detection and immediate response to potential fraudulent transactions, reducing financial losses and protecting customers.

Real-time analysis and adaptation to fraud patterns

The dynamic nature of financial fraud requires adaptive and agile solutions. AI and ML algorithms continuously learn from new data and can adapt to evolving fraud patterns, making them highly effective in fraud detection. Unlike rules-based systems, which require manual updates, ML algorithms can automatically update their models as new fraud patterns emerge. This real-time analysis and adaptation enhance the accuracy and efficiency of fraud detection efforts.

Improving Customer Experience

Customer-Centric applications

AI and ML technologies have revolutionized the customer experience in financial services. These technologies are deployed in various customer-facing applications to enhance convenience, efficiency, and personalization. By leveraging AI-powered solutions, financial institutions can offer customers a seamless and user-friendly experience, improving overall satisfaction and loyalty.

AI-Powered chatbots

AI-powered chatbots enhance customer experience by providing real-time support, answering queries, and assisting with basic transactions. This eliminates the need for extended wait times and frees up human agents to focus on more complex issues. This leads to improved response times and cost savings for financial institutions.

Personalized recommendations

AI and ML algorithms analyze customer behavior, preferences, and historical data to provide personalized recommendations. This enhances the customer journey by offering tailored investment options and relevant financial products, ensuring customers feel valued and understood. Financial institutions should align with their unique needs and goals.

Automation for seamless transactions

Automation is crucial for improving customer experience, as AI and ML technologies automate processes like account opening, loan applications, and payment processing. This eliminates manual tasks, speeds up transactions, and reduces errors, resulting in a more seamless and efficient customer experience.

Enhancing security

AI and ML significantly improve security and fraud prevention, boosting customer trust. Real-time analysis of customer behavior and transactions detects suspicious activities, proactively protecting financial institutions and assets, instilling confidence in their services.

Key Takeaways

While AI and ML bring powerful tools and insights to finance, it is essential to remember that they are not substitutes for human expertise. Financial decisions involve complex factors and individual circumstances that may require personalized advice from qualified financial professionals. It is crucial to seek guidance from experts who can provide tailored solutions based on individual needs and goals.

The continuous advancement of AI and ML will undoubtedly shape the future of finance, opening up new opportunities for innovation, efficiency, and customer-centricity. Financial institutions that embrace these technologies and combine their capabilities with human expertise will be well-positioned to thrive in the ever-evolving landscape of financial services.

However, it is crucial to remember that AI and ML are tools that should complement, not replace, the insights and guidance provided by qualified financial professionals. For personalized and tailored financial advice, individuals and businesses should always consult with experienced experts who can take individual circumstances and goals into account.